The Rise and Fall of Giants?

The Future Does Not Fit in the Containers of the Past. Edition 186.

When companies like AT&T, IBM, General Electric and General Motors were the world’s leading organizations in the 20th century, it seemed as if they might always occupy their lofty positions. Few could envision the emergence of new, dominant companies and industries. Apple, Google, Amazon and others rose with astonishing speed to become leaders in their categories.

Will this new era of the four shifts of power, demographics, mindsets and technology bring about a tectonic change in the corporate landscape?

A New Breed of Companies?

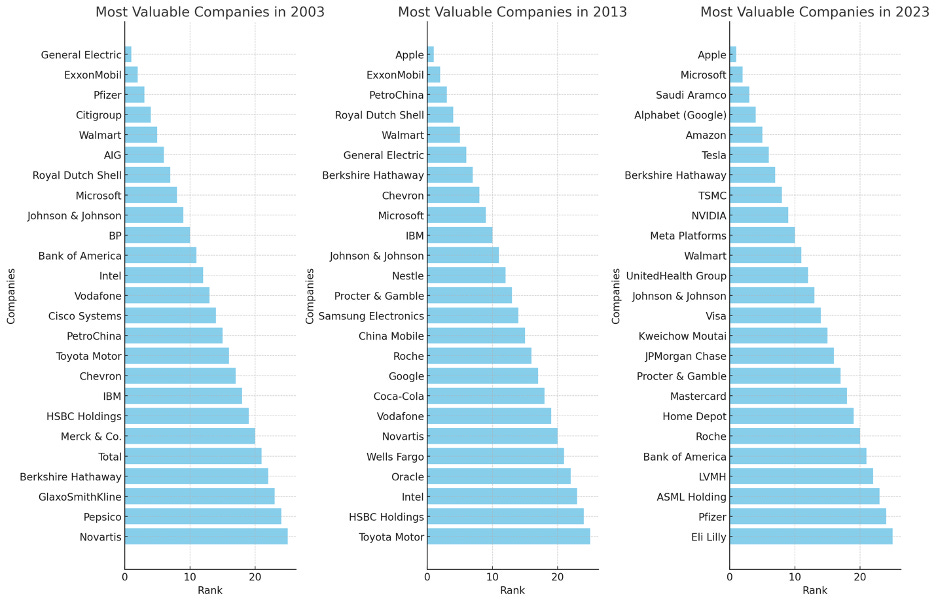

Will the same scenario take place in the years ahead? As tempting as it might be to predict that we’ll have a similar changing of the guard in the future, the following graphic provides a needed corrective to this thinking, showing the most valuable companies over the last three decades (Source: GPT-4):

The lists are surprisingly similar, with four types of companies dominating the list (technology, pharmaceuticals, energy, and financial powerhouses) and Walmart.

This is a decade, two decades and three decades after the birth of the Internet. With the exception of GE, most of the companies or their immediate competitors remain the same over two and sometimes three decades.

Some new technology companies like Apple, Nvidia and Taiwan Semiconductor make the list today, replacing a Nokia, IBM, and Intel. Why? Because Nokia failed to re-imagine phones and let Apple thrive; Intel failed to re-imagine chips, allowing Nvidia take the lead; and IBM couldn’t grasp the next generation of many things including silicon manufacturing, giving Taiwan Semiconductor an opening to dominate.

But overall, the top lists are remarkably similar by type of company with really only one new entrant, Meta, built on the relatively new social media category.

Given this historical performance, the list of leading companies a decade from now shouldn’t be that much different from the 2023 list. It’s likely that Apple, Alphabet, Microsoft, Berkshire Hathaway, Johnson and Johnson, JP Morgan, Procter and Gamble and Walmart will remain in the top 25. Accompanied by a big Credit Card company, a chip manufacturer, and a big energy firm or two. Tesla may remain if it morphs into an energy or AI firm but otherwise it may be a one decade wonder.

They and other major corporations have been taught the need to adapt and incorporate the latest technologies and ways of working and learning—the cautionary tales of Nokia and GE have not been lost on them.

At the same time, we’re bound to see the rise of certain companies in certain industries:

AI: While Alphabet and Microsoft are well on the way to become giants of an AI age, they are likely to be joined by new players such as ByteDance, the parent of Tik Tok, Open AI and other firms being newly launched. Will Nvidia which just in the past few months has risen to being the third most valuable company linger on these lists for decades or will new open and light models from companies like France’s Mistral reduce its expected dominance?

Biotechnology: In addition to AI, it is likely that a new giant or two focused on biotech like a Moderna will emerge.

Climate Technology: As concern about climate grows, so too will the companies in the category—at least one is bound to emerge from the pack, especially if they’re able to address major concerns in a way that is innovate and effective.

Tech Enabled Disruptors: These might be a Stripe or a Snowflake or companies of the same ilk.

India: In addition it would be surprising if a decade from now if one or two companies were not from India whether it be a Reliance, a Tata or a Adani.

Companies will operate differently.

While the mix of leading corporations may not change dramatically, they will operate differently from the way they did in the past.

Fewer employees due to increased productivity: They will have fewer full-time employees because they will leverage the power of AI to do more with less and use marketplaces to utilize more part time workers to ensure flexibility and speed in a shape shifting world.

This does not mean there will be less employment since some companies while being more productive will be more profitable and fast growing. In addition significant job growth will come from a larger number of smaller companies as well as many people earning income from more than one company or gig at the same time.

They will be far more geographically distributed: As the world becomes far more multi-polar with the continued rise of India and China among others and the ability of modern technology such a spatial computing to facilitate working from anywhere.

Employee Joy: It is likely that companies will run with a greater focus on employee joy as talent and culture will become the key differentiator as other areas become commoditized.

In an increasingly advanced digital silicon world, almost everyone will have access to the same tools and technologies and the differentiation will come from traditional analog carbon wealth called people or humans. Leaders and companies that can attract, retain, grow and align this human capital will be the ones that will flourish.

A Whale and Plankton Eco-System of Mutual Enforcement.

Perhaps the biggest change in the eco-system of companies will be the proliferation of smaller companies connected directly and indirectly to the giants. As members of younger generations want to work independently or pursue side hustles and as technology makes this increasingly feasible, the giant corporations will become reliant on millions more small businesses and independent contractors.

It will be the whale-and-plankton paradigm.

The debate between big and small is a false debate because the future model will need big and small working together.

There will continue to need to be the need for “old scale” which is the scale of resources, scale of size, scale of spending and scale of manufacturing in almost all industries.

To create break throughs in computing, bio-technology, transportation or many other fields one will require the investments to capital, huge pools of data and the ability to invest in R&D over years as the large pharma companies such as Merck or Pfizer, technology companies like Google and Microsoft and transportation companies such as GM and Toyota do.

It takes tens of billions of dollars to create the architecture for AI for instance.

On the other hand these large companies create the infrastructure as well as the spending power that allows thousands of other companies to feed off their investments, spending, distribution and pioneering.

This is where the new scale of networks, talent, ideas and creativity will be the differentiators.

Apple supports tens of thousands of developers who leverage the App store, Google’s You-Tube enables millions of creators, Amazon enables sellers and Microsoft provides cloud and computing services that anyone can plug into.

But it is not just the small companies that feed of the big but the big ones feed of the small both in generating income through fees (cloud services), commissions (percentage of revenue for being listed on an app store), revenue generated ( You-Tube running advertising against creators) but also as places of innovation or talent that they can buy and scale ( Meta bought Instagram, many pharmaceutical companies buy smaller bio-tech firms)

This dance of big and small constant and continuous will continue in the future.

It will less be a rise or fall giants but the dance of an eco-system of companies and talent constantly connecting, flowing and adapting as they seek growth.

The future will be fluid and to thrive it will be key to be flexible both as an individual and a firm.

Photography by Aline Smithson

Rishad Tobaccowala helps leaders and companies see, think and feel differently about how to grow themselves, their teams and their business.

Thank you for many great insights backed by wisdom, experience and solid evidence.